The clean beauty movement has reshaped the beauty industry and will continue to evolve as consumer expectations change. For many years, the clean beauty movement has been defined by absence of certain ingredients in their product:

No parabens. No sulfates. No microplastics.

But the conversation is shifting.

Today, conscious consumers are no longer satisfied with just knowing what is left out in their product. They want to know:

What ingredients are present in their skincare? Where did these ingredients come from? And how does the presence of these ingredients impact the planet, or even the societies behind its production?

The “Eco Economic” (source) and “Value Shift” (source) consumer trends in 2023 emphasised an increasing number of consumers prioritizing environmental and societal impact over personal benefit when making purchasing decisions.

It’s no longer just about “what’s good or bad for me.” It’s about what’s right for the world, including the climate, the ecosystem, and the communities affected by every supply chain decision.

This is the new era of ingredient transparency, where traceability, accountability and climate impact are becoming the new baseline for trust.

Transparency is not just a trend, it is a demand.

A global survey conducted by IBM and the National Retail Federation (source) found that:

This is not just lip service. We are seeing the largest beauty group, L’Oréal, publicly committing to “radical transparency” and “green sciences” as the foundation of its future portfolio. To display its commitment, the brand even published an ingredient database that addresses the ingredients behind every formula it launches (source).

With industry leaders like L’Oréal setting new standards, there is no doubt that more suppliers and competitor brands are expected to quickly follow suit or risk being left behind. Brands that ignore this shift, or worse, engage in greenwashing, risk more than bad press. They lose consumer trust, and with it, loyalty, reputation, long-term relevance, and revenue. Indeed, in a survey conducted by the non-profit Nuremberg Institute of Market Decision (NIM), some 72% of respondents said that they steer clear of businesses accused of making false climate protection statements (source).

Furthermore, with new European Union (EU) regulations raising the bars for the beauty industry, this pressure intensifies. The industry need not only meet the demands of consumers but also the requirements of regulators.

From the EU Green Deal to the Deforestation-Free Products Regulation (EUDR), and the Green Claims Directive, policymakers are making it clear:

Ingredient sourcing must be verifiable, traceable, and climate aligned.

Together, these policies signal a new era for the beauty industry, one that evolved beyond just “clean” ingredients that are good for the individual.

Next-generation clean beauty demands “clean” sourcing: transparent, ethical, and considers the triple bottom line of planet, people, and profit. The quintessential ingredient is one that delivers not only on performance but also supports ESG goals, regulatory compliance, and science-backed climate impact reduction.

The oil problem in skincare today.

Oils, or even more pervasively, oil-derived lipids (e.g. Fatty alcohol, esters, etc.), sit at the foundation of modern cosmetics, turning up in everything from moisturisers to makeup.

Palm oil, fossil oil, coconut oil, cocoa butter, jojoba oil – these are names of some of the most popular oils used in the industry. These names may sound natural or harmless, but behind them lies a heavy environmental cost.

Let’s zero in on the two oils that dominate the conversation:

Palm Oil

Palm oil or palm kernel oil derivatives such as the fatty alcohol Stearyl Alcohol, the ester Isopropyl Palmitate and Caprylic/Capric Triglyceride are found in at least 70% of all cosmetics (source). Despite its widespread use owing to it being the most productive oil plant in terms of yield (about 4 t oil/ha/yr, versus <1 t for most others), palm oil remains one of the most controversial ingredients in the beauty industry due to its strong association with land-use and global deforestation.

As demand for palm oil continues to rise across various industries, including the beauty industry, the need for additional land to establish new plantations follow suit. While it is possible to plant oil palms on degraded land or land previously used for other crops, this is not always the case.

In fact, scientific studies by the European Commission in 2019 indicated that 45% of new palm oil plantations are established on lands that was previously forested, a far higher percentage than other oilseed crops, such as soybeans (8%). Between 2008 and 2011, palm oil expansion alone was responsible for 4,300 km² of global deforestation (source).

Another study in 2019 identified oil palm plantations as the leading cause of deforestation in Indonesia. Between 2001-2016, oil palm plantations were responsible for nearly 25% of all permanent forest loss in the country. This scale of deforestation poses serious environmental risks; compared to rainforests, oil palm plantations are capable of supporting only one-quarter the number of animal species. As a repercussion, critically endangered species like the orangutan and Sumatran tiger, along with other smaller animals, are forced out of their habitats, causing biodiversity to be severely threatened (source).

Climate impact wise, oil palm trees have less than 20% of the above-ground biomass of rainforest ecosystems (source), meaning they store far less carbon. As a result, the replacement of forests with these monocultures not only emits stored carbon but also reduces the land’s long-term ability to absorb CO₂, exacerbating the rate and impact of climate change.

Mineral Oil (derived from fossil fuels)

Mineral and so-called synthetic cosmetic oils (listed on INCI labels as paraffinum liquidum, petrolatum, microcrystalline wax, etc.) are distilled directly from crude petroleum. They have been beauty-formulation workhorses for decades because they are cheap, colourless, odour-free, and inert. And, if you only assessed this fossil-derived oil through a narrow cradle-to-refinery-gate lens, their headline greenhouse gas intensity may appear comparable to, or even lower than some conventional vegetable oils.

Simple carbon table for greenhouse gas emissions:

| Oil (Cradle-to-gate) | GHG emissions (kg CO₂-eq / kg) |

| Mineral/Synthetic (Fossil) | ≈ 3.5–4.1 |

| Palm Oil (Non-Certified) | ≈ 5.3 |

| Palm Oil (Certified) | ≈ 3.4 |

| Coconut Oil | ≈5.7 |

| Olive Oil | ≈2.1 |

However, here is the thing: once you widen the lens to include full life-cycle emissions, regulatory, and reputational context, it becomes immediately obvious that this fossil-based ingredient is a costly liability for brands that want to stay credible on climate and transparency.

Fossil oil is made from carbon that has been locked away in geologic formations for tens to hundreds of millions of years. Once refined, used, and disposed (oxidation during incineration or slow degradation in landfill), its carbon is irreversibly transferred to the atmosphere, where it will persist for centuries and add to cumulative greenhouse-gas concentrations.

Also, most life-cycle assessments (LCAs) for cosmetics stop at the refinery fence. This means that anything that happens before crude oil enters the refinery is simply excluded.

They tend to omit:

Yet, the emissions from these overlooked upstream stages can represent a significant portion of the total fossil fuel footprint, sometimes adding 15-30% or more to the emissions from burning the fuel (source), pushing the actual greenhouse gas emissions well above frequently quoted numbers.

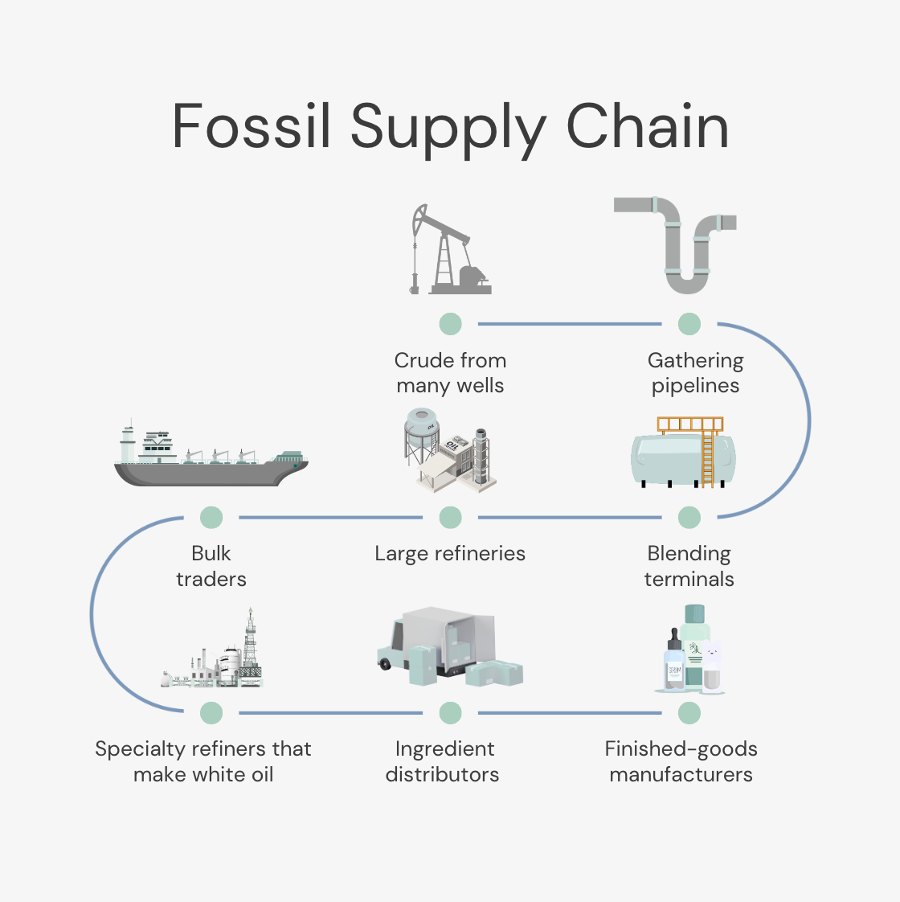

Fossil supply chains are basically a traceability black box. Barrels from hundreds of wells are blended in tanks and pipelines long before they reach a white-oil refinery.

Once the first blending occurs, it becomes effectively impossible to prove origin, labour practices, or actual GHG intensity for any given tonne of fossil oil. This makes it now unfeasible for brands to prove “responsible sourcing” to regulators, investors, auditors and customers.

Furthermore, rating agencies (e.g., MSCI, Sustainalytics) penalise “incomplete or unverifiable supply-chain data”, resulting in a lower ESG score that can raise the cost of capital and limit access to article 9 or impact-focused funds.

Besides, with the European policy stepping up demands for every ingredient that goes into beauty products, fossil-derived oils are beginning to look expensive and risky.

For example:

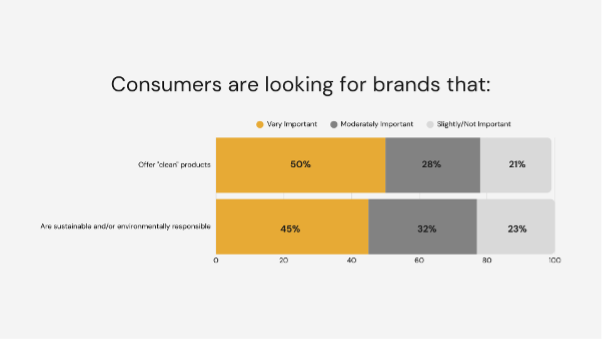

Finally, looking at stakeholder’s expectations, over 7 in 10 consumers say it’s at least moderately important that brands offer “clean” products (78 percent), are sustainable and environmentally responsible (77 percent) (source).

However, academic perception studies show that products labelled “petroleum-derived” rank lowest on perceived sustainability, below plant-based or circular alternatives (source). Impact-oriented investors echo that sentiment: Article 9 funds screen out supply chains with fossil exposure.

The bottom line is that a mid-range carbon number cannot “rescue” fossil-derived oil from its core problems. Brands that want to stay relevant on climate and remain compliant with EU regulation will need to start making plans to future-proof their ingredients, and to eventually phase out the use of such fossil-derived oils.

Enter: planet-first ingredients – meeting the new transparency test

Everything we have covered so far leads to a simple insight: if an ingredient’s story cannot stand up to public scrutiny or EU’s tightening rules, it will not belong in tomorrow’s beauty aisle.

So, what does an ingredient look like when it is designed for this new environment of “show-me-the-evidence” transparency?

The next generation of ingredients in the beauty industry must be able to meet this stricter brief as ingredient transparency is fast becoming a licence to operate.

Bridging to a workable solution

Multiple technologies are racing to answer this brief, but one stands out for oils in particular: microbial fermentation.

If the word fermentation feels unfamiliar in the context of oils, remember that fermentation is not new to the beauty industry (think hyaluronic acid or niacinamide, and even certain peptides). What is new is using the same, clean process to produce the bulk oil itself.

Because fermentation happens in closed tanks fed with precisely measured inputs, every batch is born with a digital paper-trail. The process is nearly land-free, bypasses deforestation risk entirely (assuming the process is not based on sugars or molasses from plants), and, when powered by renewable energy, a fermenter can deliver thousands of litres of high-purity oil on a footprint no larger than a city warehouse.

As a result, formulators can replace a land-intensive or fossil-based oil with a traceable, low-carbon alternative right now and see immediate changes in Scope-3 calculations, with no need to wait for new plantation certifications or the next leap in crop yields.

From concept to market-ready

A growing group of companies are scaling fermentation-derived lipids. One example is Colipi, based in Hamburg, which produces “Climate Oil™” from organic side-streams today and is actively building a carbon-negative route that feeds microbes captured CO₂. Early LCAs show the yeast pathway landing only 0.3 kilogram of CO₂ per kilogram of Climate Oil™, while the CO₂ pathway is modelled to remove more carbon than it emits.

Crucially, the fatty-acid profile of Climate Oil™ matches the needs of existing beauty products which makes it convenient for formulators to test performance without rewriting an entire INCI deck.

Why it matters now

Regulation will only tighten.

Capital is moving.

Consumers are watching.

Brands that begin trialling planet-first, fermentation-based oils now will have the documentation, the marketing narrative, and the operational familiarity in place before transparency moves from competitive advantage to basic compliance. In the new era sketched at the top of this article, the era where every ingredient must prove its planetary worth, that head-start could be decisive.

Want to explore how a fermentation-based oil can fit seamlessly into your supply chain?

Discover more at www.colipi.com.

Or reach out to us at hello@colipi.com.

We are here to help.